Explainers

Income Tax Reconciliations

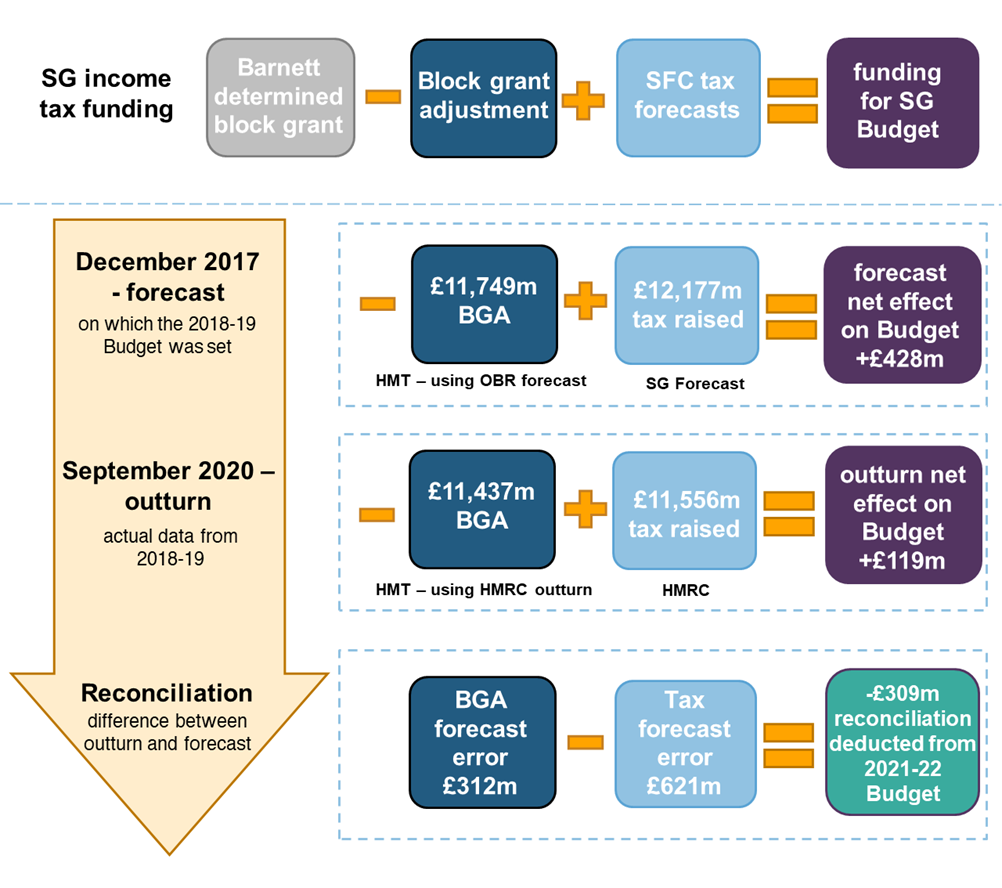

The Scottish Budget is set in advance of each financial year, based in part on Scottish Fiscal Commission (SFC) and Office for Budget Responsibility (OBR) forecasts.

The SFC’s forecast sets the amount of Scottish income tax revenues to be transferred to the Scottish Government. The OBR forecasts income tax revenues in England and Northern Ireland, which are the basis to calculate the income tax Block Grant Adjustment (BGA).

Outturn data become available over two years later. This information allows calculation of forecast errors for both the BGA and tax revenue. The combined forecast error becomes a reconciliation applied to the next Scottish Budget.

The long time it takes for outturn data to be released means there is a lag of three years in the income tax reconciliations. For example, an income tax reconciliation worth -£309 million was applied to the 2021-22 Budget, related to income tax collected in 2018-19. The following diagram shows how this reconciliation came about.